In a recent episode of Keeping It Real, Michael "Mo" Oden shared his innovative approach to uniting institutional investors with the world of affordable housing.

As the CEO of dreamhometoday.net based in Atlanta, Georgia, Mo brings over two decades of real estate experience to the table.

In this article guide, we'll delve into his unique strategies for creating a symbiotic relationship between realtors and institutional investors in the lucrative space of affordable housing.

Mo's Journey and Unique Business Approach

Mo's real estate journey began in 2002, and he has since become a prominent figure in the industry. What sets him apart is his ability to generate over half of his revenue from institutional investments. His introduction to this niche came through a friend with ties to a nonprofit seeking investment opportunities.

The collaboration proved to be a success, with Mo identifying a perfect lot for affordable housing, earning a commission, and facilitating homeownership for many.

This win-win-win scenario is a testament to the potential of this line of work.

Getting Started in Institutional Investment

Mo believes realtors have a significant advantage in the institutional investment space.

His advice is straightforward: start building relationships by reaching out to organizations involved in affordable housing development.

Here's a detailed exploration of each step to guide you through the process:

Step 1: Identify Key Players

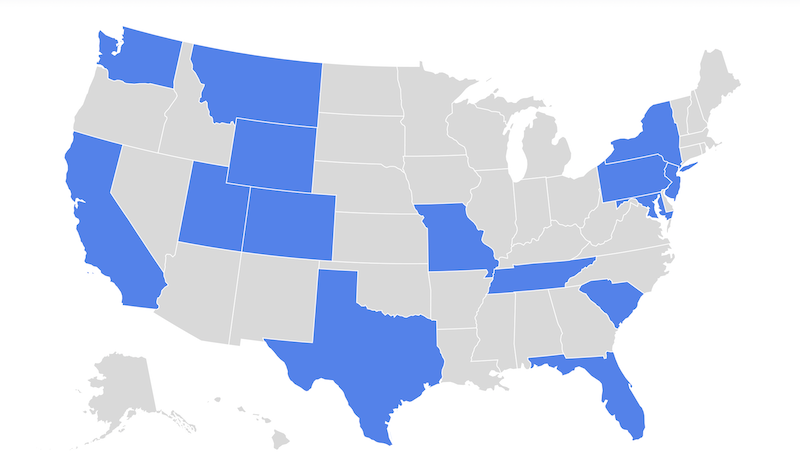

Begin by conducting a thorough search for "affordable housing development in [your city]."

This will unveil the organizations actively contributing to community development through affordable housing.

You'll probably find a combination of the big players in the space, like for-profit sites such as HomeVestors, but you'll also find nonprofits and small mom and pop groups.

Mo suggests starting with small groups and building from there – the investment space is small, but very connected.

Step 2: Understand the Investor's "Buybox"

Engage potential investors by asking a crucial question:

"What's your buybox?"

This inquiry not only demonstrates your industry knowledge but also signals your commitment to serious business. Essentially, you're seeking to understand their investment preferences and goals.

Step 3: Gather Detailed Information

Once you've initiated contact, delve into a deeper understanding of the investor's criteria.

Aim to have a profound understanding of the communities they want to invest in, the types of properties they prefer, and the desired land size.

This information becomes crucial as you embark on the quest to find the best opportunities for them.

Step 4: Actively Search for Opportunities

It's your time to shine.

Armed with a clear understanding of the investor's preferences, embark on a journey through your local real estate landscape.

Use multiple resources, from driving around time in search for lots to the MLS. Your goal is to identify properties that align with the investor's criteria.

Step 5: Present the Opportunities

Your goal here is to become the person who's gonna save these people time.

These people have the money, but they don't have the resources to go around time looking for lots or negotiate prices.

That's where you come in. Contact them, and let them know that you found some great opportunities for investment.

And don't just tell them – present these opportunities to them on a document that preemptively answers all of their questions.

This Acquisition Summary should have:

-the price of the lot

-the terms and conditions of the lot

-the due diligence

-how much earnest money is

-when the closing date is

-what's the zoning

-whether they have a survey

Think about it – these investors now have a person voluntarily finding them opportunities and presenting them in a concise way, so they can make a quick assessment.

That's the definition of an invaluable asset.

Final Step: Be Patient and Persistent

Navigating the world of nonprofits and investment institutions requires patience.

Recognize that these entities may move at a slower pace.

On the flip side, this world is well connected, and once you become the go-to person for one of these groups, you'll end up becoming the go-to person for several of them.

The other great thing about these investment groups and nonprofits is that you won't have to negotiate your commission too much. As we said before, these people have the money, they just need someone to build key relationships and find them opportunities to further their mission.

So stay consistent. Continue finding and presenting opportunities, and become the liaison between them and valuable lots.

Digging Deeper into Opportunities

Mo emphasizes the importance of thorough research, citing an example of a seemingly overlooked half-acre commercial lot that, upon closer inspection, was actually zoned for residential use.

This diligence led to a successful deal where Mo's client built ten townhomes on the property.

Karma-Positive Opportunities

In challenging market conditions, churches with declining memberships present opportunities for institutional investments.

Many churches own buildable lots with Planned Unit Development (PUD) zoning. By tearing down the church, investors can utilize these lots for residential development.

But before you squirm at the idea of tearing down a church, understand who's buying these lots.

Corporations are buying something called Affordable Housing Tax Credits, so that they can minimize their tax liability.

The catch? These credits need to be used for nonprofit work.

So these major players are working with local nonprofits who have a mission to improve their community.

This means that, yes, while you might be tearing down a church, you'll be helping nonprofits in their mission of building affordable houses for families to find their first home, thus improving the neighborhood.

Karma-positive, right?

Leveraging Real Geeks for Success

Mo utilizes Real Geeks and Zoho to streamline his business operations.

Real Geeks serves as his front end for organic traffic, allowing him to monitor leads' activities and tailor his approach accordingly. Zoho acts as his comprehensive business operating system, managing files, emails, and surveys seamlessly.

You can check out more of the Real Geeks integrations that were built to streamline your work here.

Closing Thoughts

Mo's journey into institutional investments began as a modest segment of his earnings and evolved into a substantial portion of his business.

As his strategy evolved, this avenue became half of his revenue. Now, institutional investments account for 60% of his portfolio.

On one end, he's making money finding opportunities for these groups and nonprofits. On the other hand, he's making money by finding the first buyers for the affordable houses that these groups build.

Aspiring real estate professionals can follow Mo's footsteps, creating a cycle of success for all parties involved.

The intersection of institutional investors and affordable housing is not just a business venture – it's a win-win-win-win scenario.

Real Geeks is a highly efficient and effective lead generation and conversion solution for cultivating, capturing, and managing leads at any stage of the home buying or selling process.

Drive traffic, capture leads, nurture opportunities, and close more transactions with a robust CRM, fully integrated custom IDX website, and marketing solutions for agents and teams of any size.

Real Geeks is one of the best lead generation and management platforms available, but don't just take our word for it – hear from customers loving their experience with Real Geeks →

/Blog/Thumbnail%20-%20The%20Hyper-Local%20Edge%20Powered%20by%20HelloCondo.png)

/Blog/Thumbnail%20-%20December%20%E2%80%9825%20%20%20Maintenance%20%26%20Quality%20Updates.png)

/Blog/Thumbnail%20-%20Emerging%20Brokers%20Time%20to%20Build%20Your%20Engine.png)